Trend | Momentum | Volume | Volatility

Momentum

💡 How strong the trend is

💡 Tells you if a reversal is going to occur

💡 Picking out price tops and bottoms

- Relative Strength Index (RSI)

- Stochastic

- Average Directional Index (ADX)

- On-Balance Volume (OBV)

- Ichimoku Kinko Hyo (aka. Ichimoku Cloud)

Relative Strength Index (RSI)

(» Show chart «)Single line scaled from 0 to 100.

> 50 = 📈 probably uptrend

> 70 = overbought = sell

< 50 = 📉 probaby downtrend

< 30 = oversold = buy

⚠️ Beware of fakeouts!

RSI & Bollinger Bands

(» Show chart «)

Confirmation when the market is turning.

-

RSI:overbought

Bollinger Bands: still expanding = no action! -

RSI: overbought.

Bollinger bands: started to contract = market is getting quiet. -

RSI: overbought

Bollinger bands squeeze together

📉 Both indicators agree to sell! The market is ready to move down.

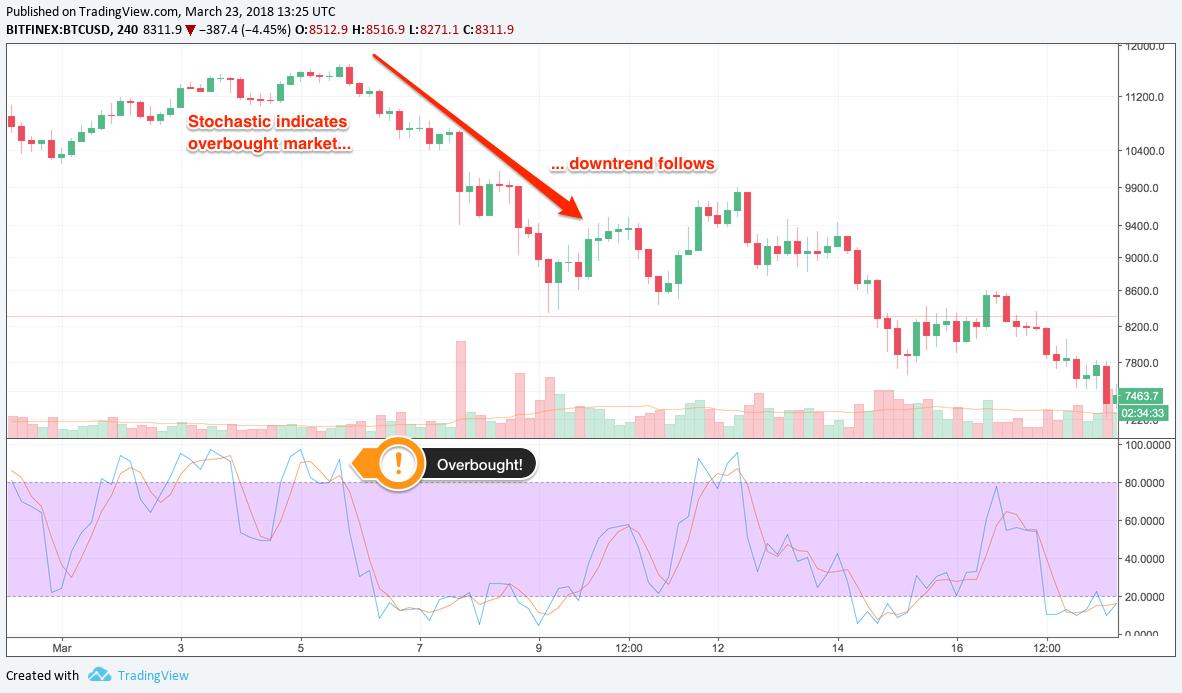

Stochastic

(» Show chart «)Find where a trend might be ending and where the market is likely to go.

Determine when an asset is overbought or oversold.

Pick an entry point = get into a trend at the very beginning.

> 80 = overbought = 📉 downtrend likely to follow.

< 20 = oversold = 📈 uptrend likely to follow.

⚠️ Beware of fakeouts!

Average Directional Index (ADX)

(» ADX DI+/DI- chart «)Signal of trend strength

Strength of the trend, NOT the direction

Range from 0 to 100

< 20 = weak trend

> 50 = strong trend

- Use ADX to avoid fakeouts.

- Best used in combination with other indicators.

- Combine with a directional trend indicator (eg. Parabolic SAR).

- Confirm that a trend is strong and is going to continue (gives you more confidence).

Settings:

- ADX: yellow

- DI+: green

- DI-: red

Yellow: shows the strength of the trend.

Green line above the red line: bulls are in control

Red line above the green line: bears are in control

Can help you to exit the trade when the trend weakens = avoid getting caught by price retracements.

⚠️ ADX lags behind the price, so is not useful if you want to get in on trends early.

On-Balance Volume

Includes

- time

- volume

- price

Theory behind it: distinction between smart money and retail investors.

- Retail investors sell, while institutions begin buying.

- Volume may increase even as the price remains relatively level.

- Volume drives up the price

- Large investors begin to sell, small investors begin buying.